Order Cryptocurrencies Rapidly and Firmly: Trusted Systems and Methods

Wiki Article

Understanding the Basics of Cryptocurrencies for Beginners

The landscape of cryptocurrencies offers a complicated yet intriguing opportunity for novices to the monetary world. Comprehending what cryptocurrencies are, how blockchain innovation underpins their operation, and the various kinds offered is necessary for informed engagement.What Are Cryptocurrencies?

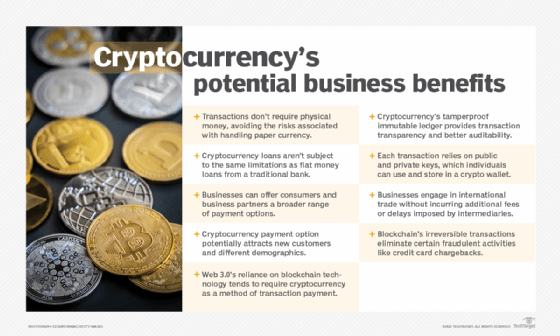

Although the idea of currency has advanced substantially over time, cryptocurrencies stand for a revolutionary shift in exactly how worth is exchanged and stored (order cryptocurrencies). Specified as electronic or online money that make use of cryptography for safety, cryptocurrencies run independently of a central authority, such as a federal government or economic organization. This decentralization is an essential characteristic that distinguishes them from conventional fiat currenciesCryptocurrencies function on a modern technology called blockchain, which guarantees openness and safety by taping all transactions on a distributed ledger. This development permits peer-to-peer transactions without the need for intermediaries, minimizing purchase costs and raising effectiveness. Bitcoin, launched in 2009, was the initial copyright and continues to be the most identified; however, countless alternatives, referred to as altcoins, have actually since emerged, each with special features and use cases.

The appeal of cryptocurrencies exists in their potential for high returns, personal privacy, and the capability to bypass conventional financial systems. Nevertheless, they come with intrinsic risks, consisting of price volatility and regulatory unpredictabilities. As cryptocurrencies remain to gain grip, understanding their fundamental nature is necessary for anyone aiming to involve with this transformative monetary landscape.

How Blockchain Technology Works

The decentralized nature of blockchain suggests that no single entity has control over the whole ledger. Rather, every individual in the network holds a duplicate, which is constantly upgraded as brand-new deals occur. This redundancy not just enhances safety and security however also promotes transparency, as all individuals can validate the transaction background.

To verify transactions, blockchain uses an agreement mechanism, such as Proof of Work or Evidence of Risk, which needs individuals to address intricate mathematical troubles or confirm their stake in the network. This procedure dissuades malicious activities and preserves the integrity of the ledger. Generally, blockchain technology represents an advanced technique to data administration, cultivating trust and performance in digital transactions without the need for middlemans.

Sorts Of Cryptocurrencies

Various types of cryptocurrencies exist in the digital economic landscape, each serving unique objectives and capabilities. The most widely known category is Bitcoin, produced as a decentralized electronic money to facilitate peer-to-peer purchases. Its success has paved the means for hundreds of alternate cryptocurrencies, frequently referred to as altcoins.Altcoins can be categorized into a number of groups (order cryptocurrencies). Initially, there are click site stablecoins, such as Tether (USDT) and USD Coin (USDC), which are secured to typical currencies to reduce volatility. These are ideal visit the site for customers seeking stability in their digital purchases

An additional classification is energy symbols, like Ethereum (ETH) and Chainlink (LINK), which provide owners certain rights or accessibility to solutions within a blockchain environment. These tokens typically sustain decentralized applications (copyright) and smart agreements.

Comprehending these kinds of cryptocurrencies is important for beginners aiming to navigate the complicated electronic money market properly. Each kind supplies unique functions that satisfy different individual needs and financial investment techniques.

Establishing a Digital Budget

Setting up a digital wallet is an important action for any person seeking to engage in the copyright market. A digital wallet functions as a protected setting for storing, sending out, and obtaining cryptocurrencies. There are several kinds of wallets available, consisting of software application wallets, equipment pocketbooks, and paper budgets, each with distinct attributes and degrees of safety and security.Software application pocketbooks, which can be desktop computer or mobile applications, supply ease and simplicity of use, making them suitable for constant transactions. Equipment pocketbooks, on the other hand, give improved protection by saving your personal secrets offline, making them perfect for lasting investors.

Once you choose a budget, download or purchase it from a reliable source and comply with the setup directions. This typically involves creating a safe password and supporting your recovery expression, which is essential for recovering access to your funds. By taking these steps, you will lay a solid foundation for your copyright tasks.

Threats and Advantages of Investing

Market volatility is a vital issue; copyright prices can fluctuate drastically within brief durations, leading to potential losses. Safety and security is an additional concern, as digital purses and exchanges are vulnerable to hacking, resulting in the loss of assets.

Financiers ought to also understand the technical intricacies and the rapidly developing landscape of cryptocurrencies. Remaining educated and conducting complete study are important to navigate these obstacles. In recap, while buying cryptocurrencies offers enticing chances, it is necessary to consider these against the integral risks to make informed choices. Recognizing both sides is important for any kind of possible capitalist entering this vibrant market.

Final Thought

In final thought, a basic understanding of cryptocurrencies is essential for navigating the electronic monetary landscape. Knowledge of blockchain modern technology, the various kinds of cryptocurrencies, and the process of setting up a digital purse is critical for protection.Report this wiki page